CARROLL DISTRESSED DEAL CASE STUDY: BELA VISTA FARM

An unconventional deal-sourcing mechanism used by the Carroll organization is the monitoring of auction houses. While it is less common for banks to auction farmland to dispose of a non-performing asset (compared to residential and commercial real estate assets), this mechanism still does occur. Carroll monitors various auction houses in Western Bahia and other regions of Brazil and has a certified auctioneer and auction capacities in-house.

In 2020, through this monitoring, Carroll identified a farmland asset slated for auction due to the non-performance of a fiduciary lien held by Bradesco, one of Brazil’s largest banks. An auction house had been hired by the bank to “consolidate” the asset and an auction was scheduled to occur.

IDENTIFYING THE ASSET: UNDERSTANDING THE AGRICULTURAL PRODUCTIVE LANDSCAPE

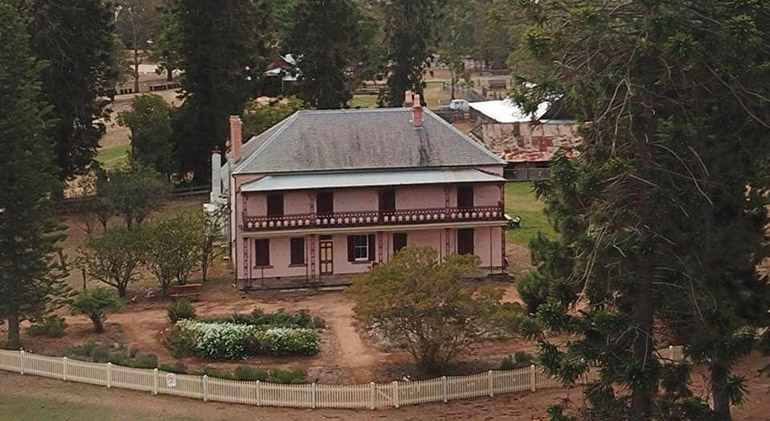

Upon identifying the potential for a deal, the Carroll team began researching background information on the asset. They identified it as 2300-hectare productive farmland with a large farmstead and grain storage and drying facilities in the Bela Vista area of Luis Eduardo Magalhaes in Western Bahia, Brazil. Soy yields in Western Bahia are among the best in Brazil due to a unique combination of climate, flat fields, elevation, sun coverage, and a focus on maximizing a primary crop (instead of trying to produce two high-yield crops per year). Within Western Bahia, the Bela Vista area has the highest altitudes and the highest rainfall, making it some of the most desirable land.

FINDING THE PRODUCER: KNOWING THE REGION AND HAVING THE RIGHT CONNECTIONS

Through Carroll’s combination of deep research capabilities and extensive on-the-ground experience and personal networks in the region, the team was able to identify the owner of the property and that he also held farmland rental contracts to produce on an additional 3400 hectares nearby.

Making contact directly with the producer, to understand his situation in greater detail and identify the possibility of a custom solution by Carroll was difficult. Using publicly listed contact information resulted in no response and was unsuccessful. It was only through personal contacts and deep knowledge of the region that contact was made via an internal Carroll staff’s contact who frequented the same church as the producer.

RECOGNIZING THE OPPORTUNITY: MAKING USE OF FIVE GENERATIONS OF PRODUCER BACKGROUND

On the production side, the Carroll organization has been successfully farming in the United States for five generations and has been operating in Brazil for 20 years with a conservative and cautious financial management perspective. They have been through the ups and downs of crop cycles, unpredictable weather, local and global financial and economic contexts, and know where many other producers make mistakes. And on a business opportunity side, they often find the best potential deals and transactions in downturns or times of distress.

Taking this experience in mind, Carroll staff connected with the producer and learned that the family had moved to Western Bahia from Southern Brazil and had been successfully farming the property for around 25 years. Poor strategic, managerial and financial decisions, along with some bad luck, resulted in significant financial distress. For example, the producer had decided to shift to planting cotton (a higher-risk crop) instead of focusing on crops like soy for which he already had significant experience. Poor weather conditions during the years of experimenting with cotton production further reduced expected yields. The family also had invested heavily in infrastructure on the farm.

The family had also attempted to refinance some of their outstanding debts but was unsuccessful in doing so. They had taken out a number of high-interest loans and even fell victim to an international farm finance scheme. In further conversations, the Carroll organization learned that they had already lost a significant amount of their equipment to creditors and were unable to continue farming on their land. Therefore, at the time in 2020 when Carroll first contacted them, their only option was to declare bankruptcy and try to avoid losing all of their farmland assets.

CREATING A SOLUTION: UTILIZING A FULL-SERVICE EXPERIENCED TEAM

Within the Carroll organization’s service side businesses, they have experts in-house for every aspect of a producer’s administrative experience, including legal and environmental services, financing and financial market services, and financial management and accounting services. Through this, Carroll is able not only to design but also execute a comprehensive solution tailored to a producer’s specific situation.

In the case of the Bela Vista farm, finding a solution was not easy. All of the family’s land was tied to mortgages, but they did have significant untapped equity. Specifically, they owed about BRL 70M against a BRL 200M asset, but the farmland was slated for auction soon. They also had around BRL 50M in debt to other sources.

The Carroll organization liked the idea of a potential deal because the properties themselves are highly productive, the potential for immediate possession or co-possession, and the distress aspect that allowed for a price entry below market.

Carroll, therefore, decided to make an offer to prepay rent and farm the property itself for 10 years with the goal of using this immediate cash liquidity to address the high-interest debts held by the producer. In this unique model, the goal was to try to allow the farmer to keep his land over time, while Carroll reserved the right to farm the land for 10 years with the guarantee that if the farmer is unable to pay back, Carroll would retain ownership of the land. In conventional bank liquidations, the land is merely sold at auction to eliminate debts, with the original farmer not maintaining ownership and no potential cash flow through production and rental agreements.

This proposal occurred near the beginning of the planting cycle in September/October 2020. While most would not take on this farming responsibility due to the need of purchasing inputs last-minute (most farmers purchase inputs like seed, pesticides, and fertilizers well in advance and over time, often using financing through the suppliers with a part of the crop production pre-sold to the supplier), the Carroll organization’s long-term internal financial management practices allowed it to have the cash flow position to do so.

In addition to the prepaid rent, Carroll focused on the issue of possession and the pending auction, working alongside the producer. Carroll’s staff worked to structure and negotiated a pre-packaged or mediated bankruptcy (not a full, formal bankruptcy) to renegotiate debts and arrangements. Aside from the immediate land guarantees tied to the auction, other guarantees could be resolved in a longer timeframe.

Carroll also negotiated the possibility of full possession of the farmland with the family should the overall terms not be met, with the understanding that in the immediate term, Carroll would be managing the land’s quality and directly producing on it.

TURNING THINGS AROUND: MAXIMIZING RETURNS ON THE INVESTMENT

The farmland itself has been properly farmed for around thirty years which adds value to the land and improves soil health to recover past yields. It also receives plenty of rainfall. However, there are still some improvements being made to address some issues of weed and pest infestations and soil compacting.

Specifically for the land investment component, in 2021, after one year, Carroll essentially purchased 75% of 2,297 hectares of farmland and the accompanying legal reserve (legally required percentage of a property that must be preserved in its natural state) for 300 sacks per hectare and averaged the sack price at $26.11 dollars. Today it is worth 400 sacks.

Land Investment Component Estimated IRR

Investment: US$ 13.5M

Return: US$ 18.6M

Unrealized gain: US$ 5.1M

Total net investment over last two years: US$ 15.1M

Total estimated return beyond investment if liquidated in May 2023: US$ 14.6M

An estimated IRR calculation shows a potential 35.4% annualized return in US dollars before considering capital gain taxes (See table on next page).

| Bela Vista, Bahia | |||||||

| Conditions: Carroll rents property (prepays rent with option to buy). Assumes all farm operations in October 2020 | |||||||

| Type of Instrument | Rent + SPA | ||||||

| Credit Purchase | 15,100,000 | to creditors with real guarantee as well as immediate urgent operational needs | |||||

| IRR | 35.4% | effective annualized internal rate of return including everything except taxes | |||||

| Expected Dates | Return of Initial Capital | Initial Investment Balance | Return / Gain | Expenses / Add. Investment | Net Cash | Cumulative Net Cash | |

| 10/15/2020 | 9,060,000 | (9,060,000) | (9,060,000) | ||||

| 5/31/2021 | 5,380,000 | 12,080,000 | 8,400,000 | (3,020,000) | (12,080,000) | ||

| 5/31/2022 | 5,530,000 | 15,100,000 | 8,550,000 | (3,020,000) | (15,100,000) | ||

| 5/31/2023 | 15,100,000 | 0 | 14,600,000 | 29,700,000 | 14,600,000 | ||

Investment: 15,100,000

Return to investor over investment value: 14,600,000

Total returned: 29,700,000

IRR: 35.4%

Multi: 1.97

Land Operating Component Estimated Returns

First Year

Rent: 13 sacks (at harvest)

Operating cost: 21 sacks (cost was lower because opportunity appeared at almost planting time so were unable to invest in the soil or purchase much fertilizer)

Total cost: 33 sacks

Investment: US$ 4.9M

Harvest/return: US$ 10.3M USD

Profit: $5.38M USD

R$ 55,509,311 revenue

R$ 26,479,021 expense

R$ 29,030,290 Net Income (after tax) / R$ 5.3958 (average Exchange rate in 2021) = US$ 5.38M

Second Year

Rent: average of 7.8 sacks (at harvest because only 3,456 hectares have rent)

Operating cost: 25 sacks

Total cost: 32.8 sacks

Investment: US$ 5.7M

Harvest/return: US$ 11.2M

Profit: US$ 5.53M USD

R$57,626,000 revenue

R$29,180,000 expense

R$28,446,000 Net Income (after tax) / R$ 5.1412 (average Exchange rate in 2022 thru Nov) = US$ 5.53M

Third Year Projection

Rent: average of 7.8 sacks (at harvest because only 3,456 hectares have rent)

Operating cost: 25 sacks

Total cost: 32.8 sacks

Investment: US$ 5.7M

Harvest/return: US$ 9.5M

Profit: US$ 3.8M

CONCLUSION: THE CARROLL DIFFERENCE

When a family faces such dire circumstances and has been deceived time and time again it is hard for them to trust another institution offering a potential solution. Carroll is an established farming family and producer service provider with a solid track record with a wide array of services that make it an excellent option to help distressed farmers, or at least make a bad situation as best as possible, and create opportunistic returns for both Carroll and investors.

Because the Carrolls are farmers, they have a distinct advantage and can sit down and “talk shop” to identify “out of the box” solutions. Carroll is also positioned as a unique player in the market that has the know-how and infrastructure to operate the farm at a moment’s notice. Additionally, Carroll has the capacity to invest and pay cash for inputs late in the season when most producers would need terms and financial assistance.

Carroll’s unique team also played a significant role in making this deal happen. Carroll’s principal owners (the family) were able to access US-based capital quickly to invest in additional machinery and resolution of immediate debt conflicts. Carroll’s human resources and financial support were able to hire employees and also work together with attorneys for debt resolution. Carroll’s farm administrator was able to quickly mobilize an operational team to be able to plant on the new farmland and leverage Carroll’s input purchasing relationships with suppliers to quickly acquire seed, chemicals, and fertilizer. Finally, Carroll’s internal legal team, along with strategic external partners, was able to effectively structure partnership and rental contracts and efficiently move legal processes through the local courthouses.